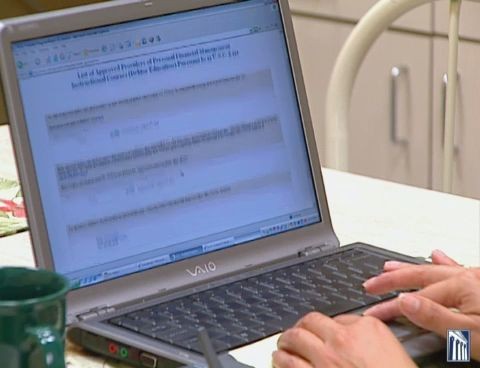

Bankruptcy is a legal proceeding to help people who cannot pay their bills get a fresh financial start, while making a fair and equitable disposition among creditors.

The right to file for bankruptcy relief is provided by federal law and all bankruptcy cases are handled in federal court.

Filing bankruptcy prevents all of your creditors from collecting debts from you, at least until your debts are sorted out according to the law.

Informational Videos

Here are some informational videos produced by the Administrative Office of the United States Courts that explain the various parts of the bankruptcy process.

Introduction

Types

Limits

Filing

Creditors

Crime

Hearings

Discharge

Legal Assistance

Frequently Asked Questions

- Remove the legal obligation to pay most or all of your debts. This is called a “discharge” of debts. It is designed to give you a fresh financial start. The discharge will normally include debts such as credit cards, medical debts, utility arrears, and other similar debts. (Not all debts can be discharged, however, as discussed later in this section.)

- Stop foreclosure on your house or mobile home will stop and give you time to catch up on missed payments. (Bankruptcy does not, however, automatically eliminate mortgages and other liens on your property without payment.)

- Stop wage garnishment, debt collection harassment, and similar creditor actions to collect a debt.

- Restore or prevent shut-off of utility service.

- Allow you to challenge creditors who have committed fraud or who are otherwise trying to collect more than you really owe.

- In a Chapter 13 case, you can keep all of your property if your plan meets the requirements of the bankruptcy law. In most case you will have to pay the mortgages or liens as you would if you didn’t file bankruptcy.

- In a Chapter 7 case, you can keep all property that is “exempt” from the claims of creditors under state law.

In most cases you will not lose your home or car during your bankruptcy case as long as your equity in the property is fully exempt. However, some of your creditors may have a “security interest” in your home, automobile or other personal property. This means that you gave that creditor a mortgage on the home or put your other property up as collateral for the debt. Bankruptcy does not make these security interests go away. If you don’t make your payments on that debt, the creditor may be able to take and sell the home or the property, during or after the bankruptcy case.

- Your credit report is accurate. Sometimes a credit card company will report that a debt discharged in bankruptcy is merely “charged off” instead of “discharged in bankruptcy”. “Charge off” is a term meaning that the creditor is no longer actively pursuing collection, but that the debt is still owed. A “charged off” notation is actually more damaging to your credit than the “discharged in bankruptcy” notation, and can hurt your chances of being approved for credit on good terms. The easiest solution is to wait approximately six (6) months after receiving your bankruptcy discharge and then pull your credit report. If you see debts that were discharged notated as “charged off”, call the creditor and have them correct the trade line on the credit report. As provided under federal law, you are entitled to a free copy of your credit report from each of the “big three” credit reporting agencies (Equifax, Trans Union and Experian) and may obtain these by visiting this website: www.annualcreditreport.com.

- Timely payments after bankruptcy. You post-bankruptcy payments to creditors (e.g. car and mortgage debts that your “reaffirmed” in your bankruptcy case) must be made timely. This will accelerate the process of restoring your credit.

- For additional information and help rebuilding your credit after bankruptcy, here is a website containing resources you might find useful: https://www.720creditscore.com/

Yes, with some exceptions. Bankruptcy will NOT normally wipe out:

- Money owed for child support, alimony, property settlements in a divorce proceeding, criminal fines, or most income taxes.

- Debts not listed on your bankruptcy petition.

- Loans you got by knowingly giving false information to a creditor, who reasonably relied on that information in making you the loan.

- Debts resulting from “willful and malicious” harm.

- Student loans

In Chapter 13 cases only, if you owe more on your first mortgage than you could reasonably expect to sell your house for, it is possible in some cases to “strip” a second or third mortgage and get rid of those debts along with all of your other debts. You may be required to incur additional cost in obtaining a new, independent appraisal of your real estate in order to show what your house is worth. Many people who would have filed under Chapter 7 find this benefit well worth the additional cost of filing under Chapter 13 instead.

Although it may be possible for some people to file bankruptcy without an attorney, it is not a step to be taken lightly. The process is difficult (especially under the “new law”), and you may lose property or other rights if you do not know the law. It takes patience and careful preparation. Chapter 7 (also known as “straight bankruptcy”) cases are somewhat simpler, but very few people have been able to successfully file and complete Chapter 13 (debt adjustment) cases on their own. Many, if not most, pro se filers end up hiring an attorney later to fix the mistakes that were made at much greater cost than would have been incurred had they simply hired an attorney to handle their case to begin with.

You do not need to bring anything with you to your first meeting with the lawyer. However, we may advise you when you call our office to gather certain things together before coming. This will save some time down the road in preparing your case for filing.

When first meeting with the bankruptcy attorney, you should be prepared to answer the following questions:

- What types of debt are causing you the most trouble?

- What are your significant assets?

- How did your debts arise and are they secured (e.g. car loans, mortgages)?

- Is any action about to occur to foreclose or repossess property or to shut off utility service?

- What are your goals in filing the case?

What Our Clients Say

Karl Wulff is great at what he does. He was always there if I had questions or concerns. Obviously, bankruptcy is a big deal and extremely stressful. He streamlined the process and made it extremely easy and was always there. Highly recommend if you're thinking about doing it. Karl if you are reading this, Thanks!

Everything was explained in detail. I had a check list of exactly what I needed and when it was due. This was a stress free experience for me. I will absolutely recommend to anyone in need!

This is an extraordinary team and I would definitely recommend this office and Mr. Wolff to everyone who’s is looking for this service. They are patient and willing to work with you through your process. They are also very knowledgeable and try to make it as simple and possible for you. You guys were awesome!!

Karl and his staff are amazing! They made the process so smooth for me. Karl and his staff always kept in touch with what was needed and what the next process would be. They are very professional. I would recommend Karl to anyone in need of his service. Awesome group, keep up the great work!!

Credit Counseling

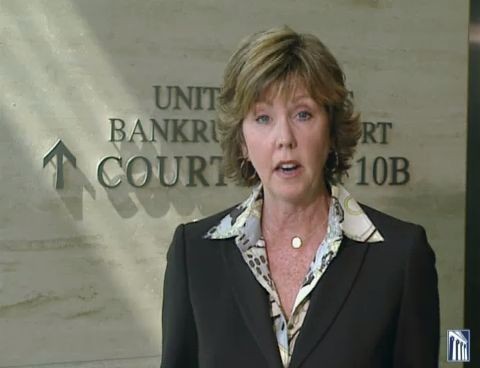

Before filing a bankruptcy case you must meet with a U.S. Department of Justice certified counselor to review your budget and your non-bankruptcy alternatives. This sounds like a big deal, but it’s really not. There are a dozen or more approved providers of this counseling service available in our district. We have audited all of them. We will refer you to the one that we believe represents “the path of least resistance”. You will “meet” with the counselor on-line or over the telephone. You will be asked about your income, expenses, property and debts. You will be given a short presentation either on the website or over the telephone. Upon completion the counselor will send your “Certificate of Completion” to our office by e-mail. Our office pays for this counseling and will advance the fee directly to the credit counseling provider on your behalf.

After filing you must complete the second part of the credit counseling requirement called the “financial management course”. Again, you will “meet” with the counselor that we refer you to on-line or by telephone.

The program provides a short demonstration of good personal financial practices such as budgeting and the correct use of credit. Again, upon completion the counselor will send your “Certificate of Completion” to my office by e-mail. Again, our office pays for this counseling and will advance the fee directly to the credit counseling provider on your behalf.

The “Means Test”

The so-called “means test” is another way of doing what we have always had to do in bankruptcy, i.e. demonstrate for the bankruptcy court that you are unable to pay your debts as and when they come due by reason of “income insolvency”.

This simply means that we must show that, in a given month, you have more going out in expenses than you have coming in in income. We do this by collecting your last six (6) months of pay stubs and comparing your projected annual gross income to the median gross income for your family size and state of residence based on recent census figures. If you are above the median income then you may have to take additional steps in order to show the court that you are entitled to bankruptcy relief.

The thing to remember here is that we will be there to assist you throughout the entire process. You need only provide us with your pay stubs and accurate information regarding your income and expenses. We do the rest.