Effingham Bankruptcy Attorneys

Bankruptcy Law Firm

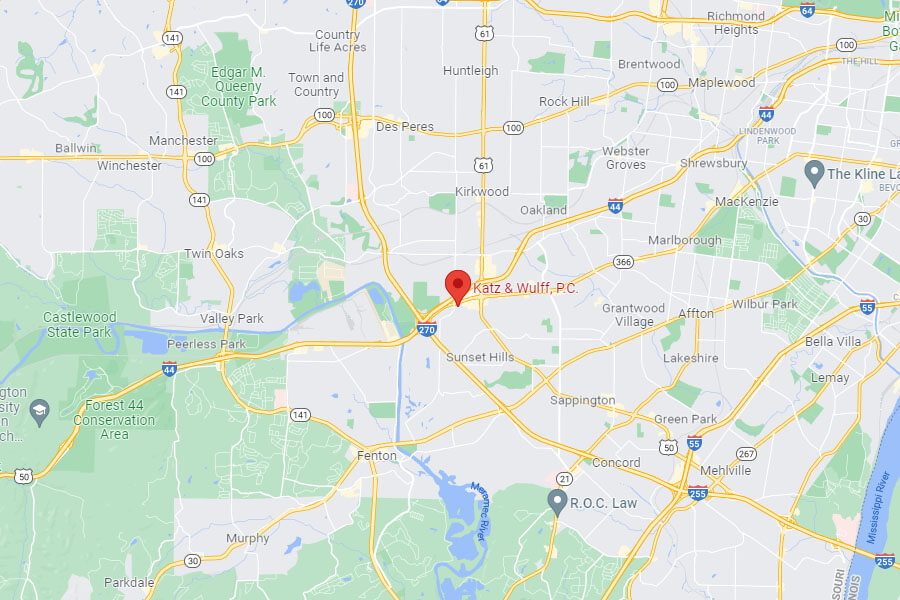

Serving All of Southern Illinois including Effingham, Sparta, Okaville, Vandalia, Mount Vernon, Pickneyville, De Soto, Marion, Salem, and surrounding areas.

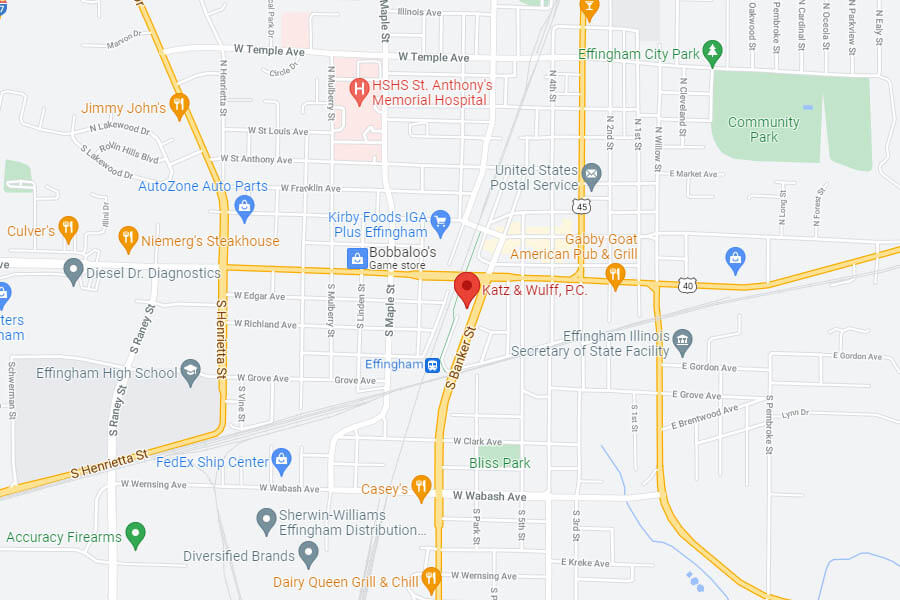

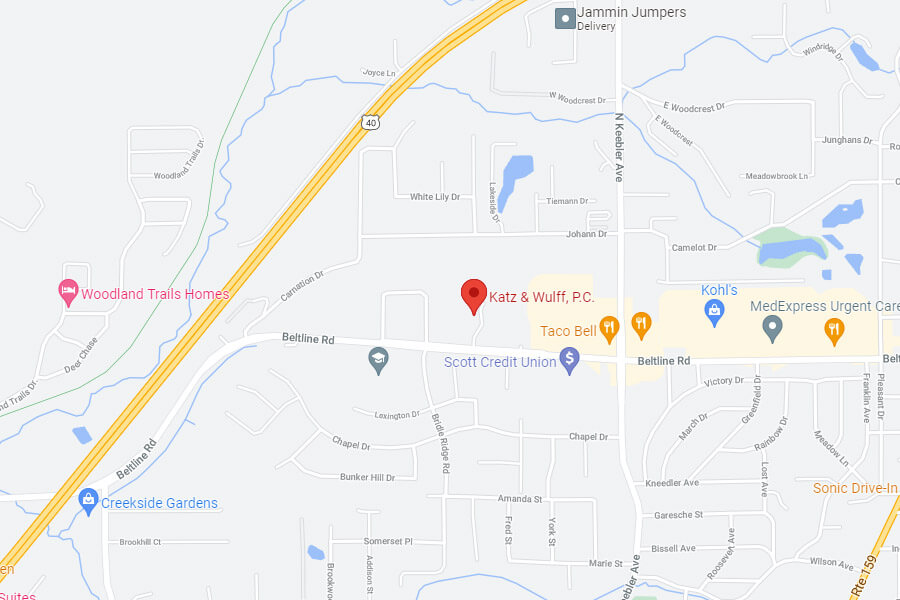

Katz and Wulff, P.C.

405 S Banker St., Ste. 205A

Effingham, IL 62401

Get Directions

Phone: (800) 339-0009

- Mon – Fri: 9 AM – 5 PM

- Sunday: Closed

- Evening and Weekends Available by Appointment

Interested in Scheduling a Consultation or Simply Asking a Bankruptcy Related Question?

We are happy to help, simply fill out the form below and we will be back in touch generally within one business day!

ALL FIELDS REQUIRED*

What Our Clients Say

Karl Wulff is great at what he does. He was always there if I had questions or concerns. Obviously, bankruptcy is a big deal and extremely stressful. He streamlined the process and made it extremely easy and was always there. Highly recommend if you're thinking about doing it. Karl if you are reading this, Thanks!

Everything was explained in detail. I had a check list of exactly what I needed and when it was due. This was a stress free experience for me. I will absolutely recommend to anyone in need!

This is an extraordinary team and I would definitely recommend this office and Mr. Wolff to everyone who’s is looking for this service. They are patient and willing to work with you through your process. They are also very knowledgeable and try to make it as simple and possible for you. You guys were awesome!!

Karl and his staff are amazing! They made the process so smooth for me. Karl and his staff always kept in touch with what was needed and what the next process would be. They are very professional. I would recommend Karl to anyone in need of his service. Awesome group, keep up the great work!!

Bankruptcy Filing Assistance in Effingham, IL

Katz & Wulff, P.C. and Attorney Karl J. Wulff are proud to offer legal bankruptcy services to Effingham, IL and the surrounding Southern Illinois area. After over two decades of practicing bankruptcy law, our firm has helped thousands of clients successfully navigate the federal bankruptcy process and how it affects those living in Illinois. Katz & Wulff, P.C. concentrates in Chapter 7 and Chapter 13 bankruptcy filings. By choosing bankruptcy, we can help you:

- End Creditor Harassment

- Prevent Foreclosure on Your Home

- Stop Vehicle Repossession

- Protect Your Personal Property

- Keep and Protect Your Retirement Savings

- Erase Credit Card Debt

Credit card debt, payday loan debt, medical expenses, deficiency debt related to car repossessions and home foreclosures, and utility expenses can all be cancelled under bankruptcy law in Illinois.

Debt Management Near Effingham

Working your way to financial freedom is not easy. Luckily, a better financial position is something that you do not have to pursue on your own. There are a handful of local business and financial institutions scattered throughout Effingham that can aid you in your quest to eliminate debt.

Why Katz & Wulff, P.C.?

When money gets tight, most individuals begin feeling a sense of desperation and stress. Unfortunately, desperate times tend to lead to desperate measures, which typically are not financially sound courses of action. In the face of overwhelming debt, many debtors fall into the trap of making bad financial decisions to alleviate debt. Such decisions include, but are not limited to:

- Borrowing money from family and friends

- Writing bad checks

- Taking out cash advances on credit cards

- Mistakenly selling assets protected from creditors

- Liquidating retirement accounts to make bill payments

- Engaging in fraudulent/illegal activity

- Securing loans from payday loan companies at interest rates well over 50%

Before doing something you may come to regret, contact a knowledgeable bankruptcy attorney. A local Southern Illinois attorney can sit down with you to review your unique case and help you weigh all of your options. In meeting with an attorney, you’ll be able to walk away with the best course of action completely laid out for you.

Even better, when you contact Katz & Wulff, P.C., you will receive advice from an attorney with more than twenty years of bankruptcy experience. A consultation with firm founder Karl J. Wulff will provide you with the information you need to get your finances back on track. Schedule your free initial consultation today.