Notices and Disclosures

Notices and Disclosures

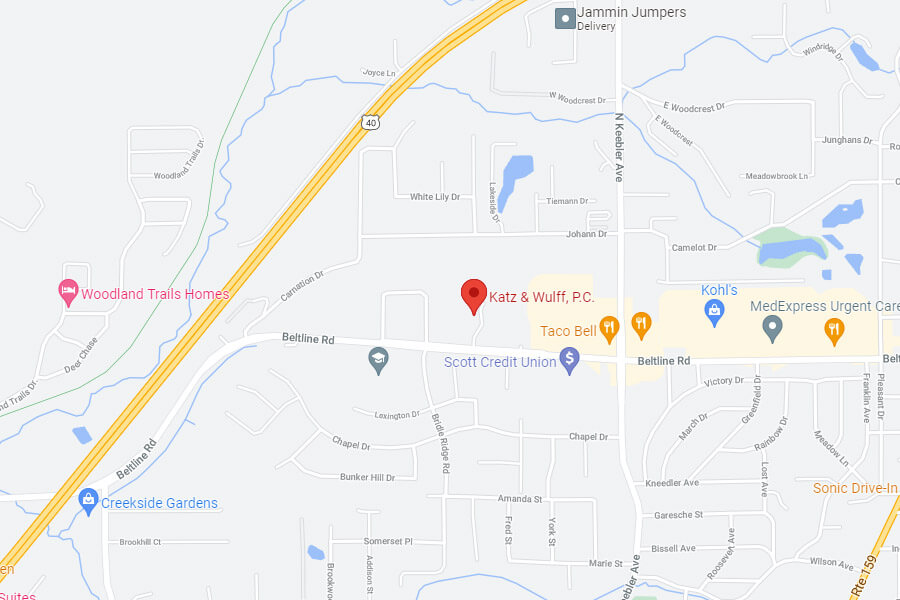

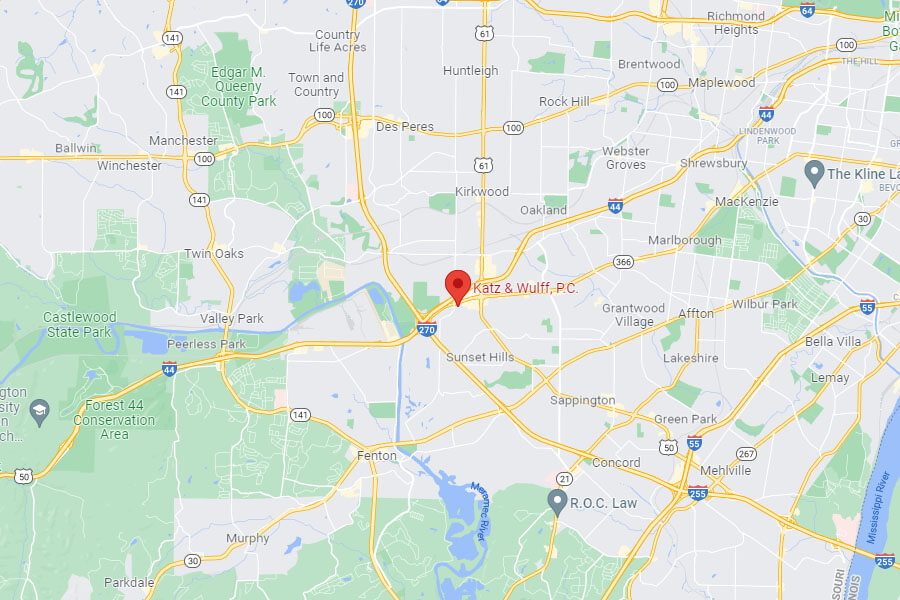

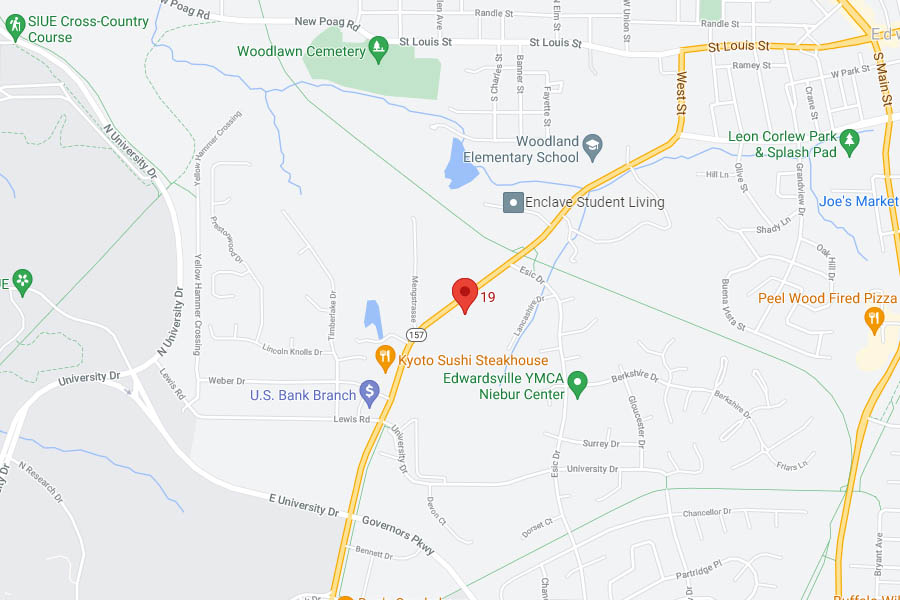

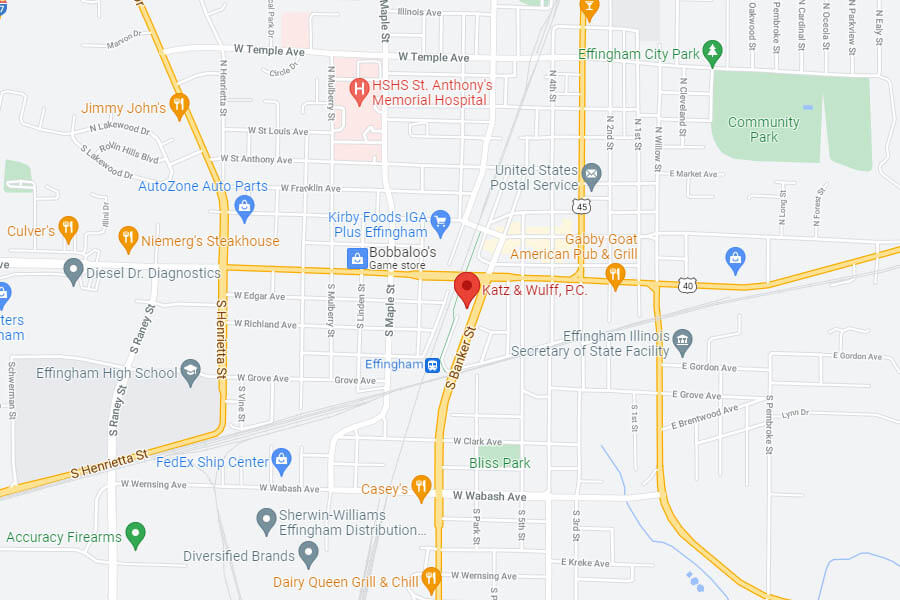

As you read and view the pages on this web site, please REMEMBER these Notices and Disclosures: The law often changes. Each case is different. This website is intended to give you general information and not to give you specific legal advice. Receiving, reading or reviewing this material does not and is not intended to create an attorney/client relationship. Katz & Wulff has been designated by the United States Congress as a “Debt Relief Agency”. We assist individuals and small businesses seeking debt relief under the United States Bankruptcy Code (11 U.S.C. § 101 et sequitur). The choice of a lawyer is an important decision and should not be based solely upon advertisements.

IMPORTANT INFORMATION ABOUT BANKRUPTCY ASSISTANCE SERVICES FROM AN ATTORNEY OR BANKRUPTCY PETITION PREPARER.

If you decide to seek bankruptcy relief, you can represent yourself, you can hire an attorney to represent you, or you can get help in some localities from a bankruptcy petition preparer who is not an attorney. THE LAW REQUIRES AN ATTORNEY OR BANKRUPTCY PETITION PREPARER TO GIVE YOU A WRITTEN CONTRACT SPECIFYING WHAT THE ATTORNEY OR BANKRUPTCY PETITION PREPARER WILL DO FOR YOU AND HOW MUCH IT WILL COST. Ask to see the contract before you hire anyone.

- The following information helps you understand what must be done in a routine bankruptcy case to help you evaluate how much service you need. Although bankruptcy can be complex, many cases are routine.

- Before filing a bankruptcy case, either you or your attorney should analyze your eligibility for different forms of debt relief available under the Bankruptcy Code and which form of relief is most likely to be beneficial for you. Be sure you understand the relief you can obtain and its limitations. To file a bankruptcy case, documents called a Petition, Schedules, and Statement of Financial Affairs, and in some cases a Statement of Intention, need to be prepared correctly and filed with the bankruptcy court. You will have to pay a filing fee to the bankruptcy court. Once your case starts, you will have to attend the required first meeting of creditors where you may be questioned by a court official called a ‘trustee’ and by creditors.

- If you choose to file a chapter 7 case, you may be asked by a creditor to reaffirm a debt. You may want help deciding whether to do so. A creditor is not permitted to coerce you into reaffirming your debts.

- If you choose to file a chapter 13 case in which you repay your creditors what you can afford over 3 to 5 years, you may also want help with preparing your chapter 13 plan and with the confirmation hearing on your plan which will be before a bankruptcy judge.

- If you select another type of relief under the Bankruptcy Code other than chapter 7 or chapter 13, you will want to find out what should be done from someone familiar with that type of relief.

- Your bankruptcy case may also involve litigation. You are generally permitted to represent yourself in litigation in bankruptcy court, but only attorneys, not bankruptcy petition preparers, can give you legal advice.